For university student Caitlin Lavery, along with all the crap COVID19 and 2020 delivered came something of a financial windfall.

When JobKeeper’s $1500 fortnightly payments started landing in her account last April, the then 19-year-old student’s income from her part time job at a local McDonalds franchise effectively doubled. The hasty deployment of the emergency program meant that initially, even part-time workers qualified for the full payment.

By September the payments had been scaled back to reflect hours worked. But in the meantime, she’d never seen so much money.

“It was definitely a lot more than I had usually been getting,” says Ms Lavery. “I was not expecting to get that much since I don’t think I’ve ever worked enough to even earn the fortnightly $600 payment that we were getting.”

Now 20 and in her second year at Deakin University, the outgoing psychology student is relishing being back in the world. With classes still mostly online, she takes a break to walk the short distance from the home she shares with her parents to St Kilda Library to chat with The Citizen and reflect on her pandemic year.

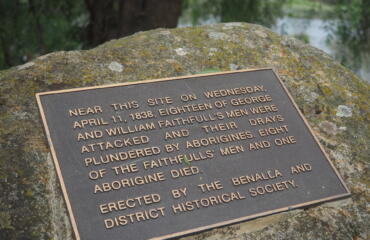

With Caitlin Lavery maintaining her normal working hours during the pandemic, she questions whether she needed the JobKeeper wage subsidy: ““There were a lot of people in my position … that didn’t really need it.” Image credit: Wayne Taylor, The Age

Income and job security were at the top of many people’s list of anxieties during the lockdown. But Ms Lavery’s stable 15-hours a week of work, which kept going throughout Melbourne’s 2020 restrictions underwritten by JobKeeper support, meant that she had enough peace of mind to put herself on a savings regime through most of 2020.

Which is not to say that she got through the pandemic unscathed. “I was just at home by myself all the time and it got very, very lonely.” Like so many others in locked-down Melbourne, she invested in a pandemic puppy.

Mable the sausage dog provided much needed companionship during the COVID19 restrictions.. “I bought a dog with what I was paid, because emotionally getting a dog made me a lot happier person.”

Online shopping also became a means of coping with the chaos outside her window. Nonetheless, she still managed to stash away a JobKeeper nest-egg, which she credits to her organised nature and a determination to be independent.

It’s notable that according to the University of Melbourne’s ‘Taking the Pulse of the Nation’ survey, in her age bracket (18-44) financial stress kicked sharply up to toward 50% in mid-February, but by mid-March – even with the end of JobKeeper looming – had dropped back to 30%. The proportion ‘making ends meet’ was similar, while 39% were feeling comfortable.

While grateful for the payments, Ms Lavery is ambivalent about the processes which delivered her windfall. The criteria for payments meant older teenagers like her, who still lived at home and were supported by their parents, were eligible for similar payments to those who were independent and dealing with significant financial distress.

“There were a lot of people in my position … that didn’t really need it,” she says.

Ms Lavery is still working her regular shifts at McDonalds and still trying to put away some money. Her priorities are putting essential spending first, food, university costs and pet insurance. “I try to allocate at least 75% of my pay into savings and the rest for spending, whereas when I was getting JobKeeper it was kind of just whatever,” she said.

With a stable part-time role and the security of parental support, she’s looking forward to getting on campus, having some real-world university lifestyle and – hopefully – some travel when such things are allowed.

This story is part of a special series by The Citizen co-published with The Age.