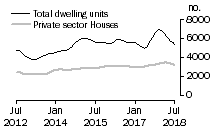

Source: ABS.

Finding a car park in the inner city is a hard ask at the best of times, but that may change.

The streets of Collingwood are choked with utes, cones dot the roads marking the territory claimed for trucks and tradies, and the sound of heavy construction grinds away as cranes grace the skyline.

Building is booming for Melbourne’s tradies. They’ve enjoyed a decade of solid growth in building, with present levels 30 per cent above long-term averages.

Throughout Melbourne’s inner-city, from 6am onwards, utes loaded up with metal toolboxes, ladders, pipes, sausage rolls and ice coffee come pouring in. Something even just five years ago was confined to far fewer areas of the city.

But what goes up must come down. In a widely watched indicator of construction activity published by the Australian Bureau of Statistics, seven months of falls in building approvals have not turned around.

This sees Victorian building levels fall from never before seen peaks, with the bottom of the fall still some way off.

Less approvals mean less fewer new apartments – and that’s bad news for everyone in the construction food chain, from the tradies to the cafes that have enjoyed a boom in early morning business.

But if you ask around the big building sites of Collingwood whether they’re aware of the coming slowdown, the response will be the same. “No idea, most of these guys wouldn’t know,” one lollipop clutching traffic director told The Citizen.

Gesturing to the queue of cement trucks and shouting to be heard over the roar of diesel engines, the tradie in Collingwood admitted that apartment building had been a boon for Melbourne’s tradies and himself.

Construction now accounts for 1 in 10 jobs in Victoria, something the state government recently celebrated. But as the industry has grown so has Victoria’s economy come to rely on it.

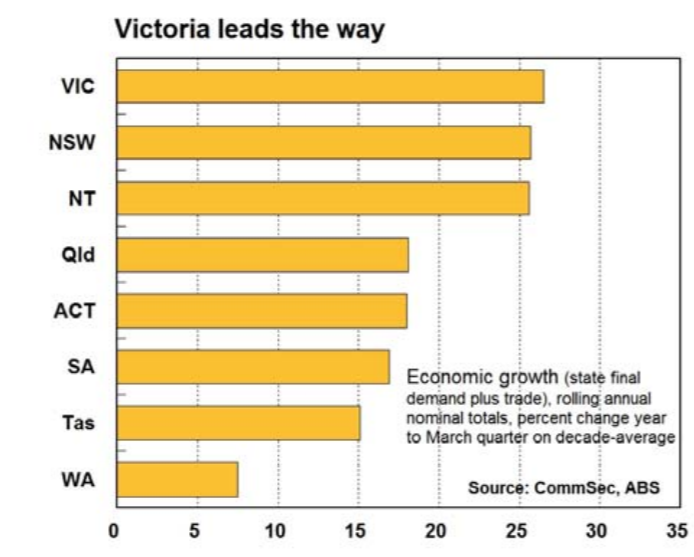

Construction helped Victoria make top spot in Commsec’s State of the States report.

Commsec Senior Economist Ryan Felsman told The Citizen construction in Victoria was at an all-time high, almost 30 per cent above the long-term average. However, a slowdown was already taking place.

But, Mr Felsman suggested, the slowdown in construction could be mopped up by the Victorian government’s planned infrastructure bonanza.

He said the sky-high construction figures in the past few years had a lot to do with the huge population growth in Melbourne in the past decade.

“At the same time we’ve seen broadly low interest rates really supporting that construction work done,” Commsec’s Ryan Felsman said.

But that’s not much help for the legion of tradies out there who can’t so easily go from pouring concrete and fitting out towers, to pouring concrete and using highly engineered tunnel boring machinery to create a trans-Melbourne train network.

Source: Commsec, 2018.

When contacted the CFMEU and ETU both declined to say whether this could be bad for their members. They both told The Citizen that they had almost no membership in those building the apartments and that for many in that industry any idea of what was coming next was “above their pay grade”.

ABS data, hot on the heels of the State of the States report, showed construction has trended downward from a peak in 2017, with the total number of dwelling units approved in Victoria falling 4.3 per cent for July, with even private houses falling 2.4 per cent.

That mirrors a national story that has seen the total value of building approvals fall, in trend terms, for eight months, putting seasonally adjusted estimates for dwelling approvals down 5.6 per cent from July last year.

The downturn will be particularly concentrated as much of the boom has come from non-private sector homes – that is to say: apartments.

So when a downturn comes it can bite. As can be noted from Australia’s recent experience, when the mining boom ended in West Australia bankruptcy boomed, as did the listings of jet skis for sale: any offer accepted.

House prices in Perth are back to where they were 10 years ago, while the southern suburb of Baldivis has just been named Bankruptcy capital of Australia.

Not all who work in construction have skill sets that can be easily applied to infrastructure construction, according to BIS economics expert Angie Zigomanis.

He said those who worked in apartment fit-outs would be the ones most exposed to any downturn as residential construction demand had remained largely constant in the past few years.

Mr Zigomanis, who is senior manager of residential property at BIS, told The Citizen the high rise apartment boom couldn’t go on forever, but that he was surprised how resilient the market had proved.

“At the end of the day it will fall away at some point,” he said.

“The big risk is if you do maintain a very strong employment growth and new construction does fall away very rapidly then all of a sudden you do risk the market tightening up in the next cycle.”

Tim Reardon, principal economist at the Housing Industry Association, said the cooling off in Victoria was something that had been anticipated for some time.

But like Commsec’s Ryan Felsman, Tim Reardon suggested the boom in infrastructure work could soak up some of the excess engineering capacity that would come from a slowdown.

“From a residential building perspective I’m not concerned about employment prospects at this stage,” he said.

He rubbished any suggestion the slowdown would be bad news, although admitting that Victoria’s construction employment levels were “unprecedented” and that a slowdown in the state’s population growth and higher building costs could flow on to slow the market.

Senior figures in the financial and building sectors have been warning of a slowdown in the wake of the crackdown on lending by the Australian Prudential Regulatory Authority to cap the number of loans to investors at 10 per cent of all new lending and the size of loans on offer, after almost a decade of property prices reaching for the sky.

The idea behind APRA’s restrictions was to tap the brakes on Sydney and Melbourne’s inner city property markets, which have gone from an era when Darryl Kerrigan being offered $70,000 for his Broadmeadows castle was an insult and the median house price for Melbourne was $177,500, to one where Melbourne’s median house price is pushing $720,000 and young people can only dream of being homeowners.

But tapping the brakes has quickly turned into spinning out, which has seen the Australian Industry Group’s Performance of Construction Index fall to 50.6 points in June in seasonally adjusted terms, the lowest level in 17-months.